Tax Implications of Selling Your Business in 2021 vs. 2022

January 22, 2021

If you are a funeral home owner, every election season can bring questions of tax implications on a sale of your business. Now that we are fully into a Biden led administration, coupled with a Democratic led Congress, The NewBridge Group continues to receive many inquiries regarding likely tax changes (primarily capital gains) and whether or not a sale should be considered sooner than later.

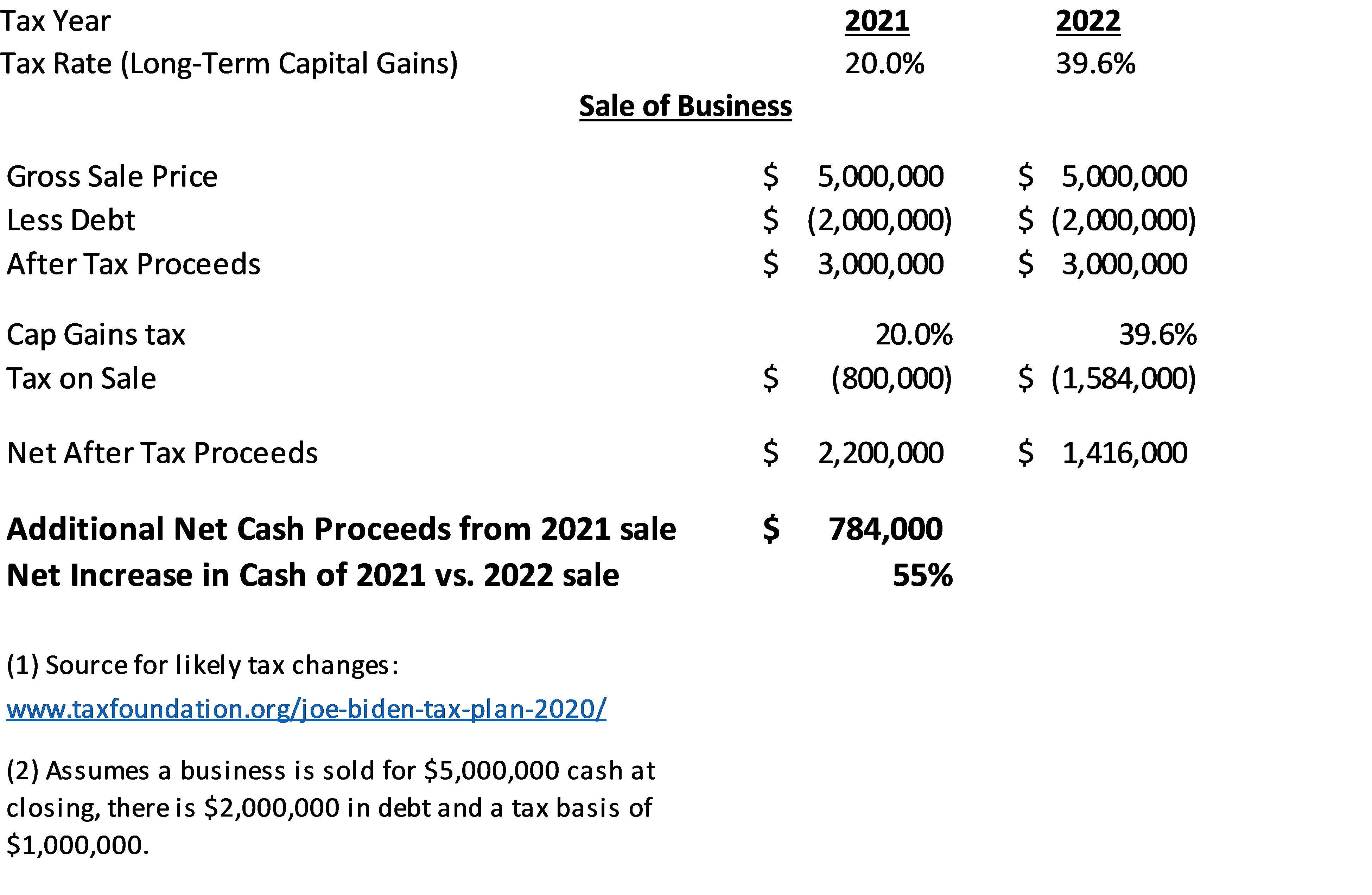

Below is a chart of the current long-term capital gains tax rate compared to the proposed Biden tax plan. The consensus is that these rates will not be retroactive, but rather will be voted on and set into place starting January 1, 2022 or soon thereafter.

In a 2018 study by SmallBusinessTrends.com(3) 41% of business owners planned to sell over the next 5 years. If you are one of these, we would highly encourage you to start the process in the next few months. The tax savings are likely to be significant. If a large part of these owners decide to sell this year, buyers will be inundated with opportunities to purchase, which will depress valuations while creating a backlog. Thus, many transactions will be unable to close before year end. Because of this, the sooner you start looking into a sale, the better.

To complete a sale before December 31, we advise being under a signed Letter of Intent by July. This means you should start the process no later than April or May.

If you are interested in exploring a sale of your business, feel free to call me directly: 404-542-9956, or email: todd@newbridgegroup.com.

(3) https://smallbiztrends.com/2018/02/business-exit-strategy.html